There was a point in time when the Finnish phone maker Nokia (NOK) was the undisputed champion in the mobile handset market and had prominent presence in several other business segments. However, after the sale of its handset business to Microsoft (MSFT), Nokia has been reduced to a telecom hardware provider and global location based service provider only.

While many consider this to be a sad situation for the phone maker, Nokia is able to see through the situation and is moving forward aggressively to the opportunities that are available. Recently the company completed the acquisition of Desti, a personalized travel planner that uses artificial intelligence to provide the user exactly what information he wants. Desti originally comes from SRI International, the same company that had developed Siri, the app that now Apple (AAPL) owns so proudly.

Nokia's Latest Possession

The acquisition of Desti by Nokia and its addition to the Here mapping division comes as a well planned move from the company. Though Here accounts for only 10% of Nokia's remaining business, the company is not talking the offering lightly. Nokia believes Desti's expertise will add greatly to Here's growth and help the app gain better user acceptance.

Desti has been available for consumer use for some time now and the overall customer experience has been very pleasing. However, following this acquisition, the app will no longer be available to consumers and it has already been removed from the App Store, and Nokia plans to complete shut down the app in the coming 90 days. Post all this, the only way one will be able to use Desti's features will be through Nokia Here. The Finnish company will be working on combining both the offerings over the next few months.

Now that Nokia handsets are not a part of the company anymore, Nokia has very different plans to support its top-line. The company will be making its offering available to third-parties. But, the question is, will Nokia limit the benefits of Desti only to Microsoft devices, or will it go for other platforms also. Industry experts and analysts are of the opinion that over the span of next four years, Nokia will keep the service exclusive to Microsoft because of the mapping deal signed by the companies. After that, Nokia will surely launch Here on parallel ecosystems. This will also give some time to the app to gain popularity.

Competition

Leisure & Lifestyle is a segment that has witnessed huge growth in the past couple of years and industry experts believe the segment has unimaginable upside potential. No wonder why so many companies are thinking of getting in to it while it is still in the development stage.

It's not just Nokia that understands the growing importance of location based services that will aid travelling. Google (GOOG) too has this in mind and is working rigorously to develop Google Maps. Recently the company acquired Quest Visual, the maker of the Word Lens app that provides instant translation of words from one language to another. The Mountain View based giant will be incorporating the features in its translation offering, as well as in Google Maps. Apart from Quest Visual, Google recently also acquired Skybox Imaging, a company that builds satellites and specializes in satellite imaging and video. Analysts believe the capabilities of Skybox will be added to Google Maps to enhance the app.

Departing Thoughts

Nokia missed the smartphone train once and lost most of its market share and eventually the story ended with the sale of its handset business to Microsoft. The company surely doesn't want to go through all this ever again. Nokia has been investing a lot of time and money in R&D and is coming up with ways to enrich its remaining offerings. The company is trying to understand the pulse of the consumers and after this acquisition, it seems, Nokia is on the right path. The journey will not be easy for sure with Google and Apple also focusing on the same audience, but the Finnish company will have to find ways to make its offerings attractive enough to gain substantial consumer acceptance.

About the author:Quick PenA seasonal writer with a Management Degree in Finance and interests in automotive, technology, telecommunication and aerospace sectors.| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

| RSS Feed | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

| RSS Feed | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

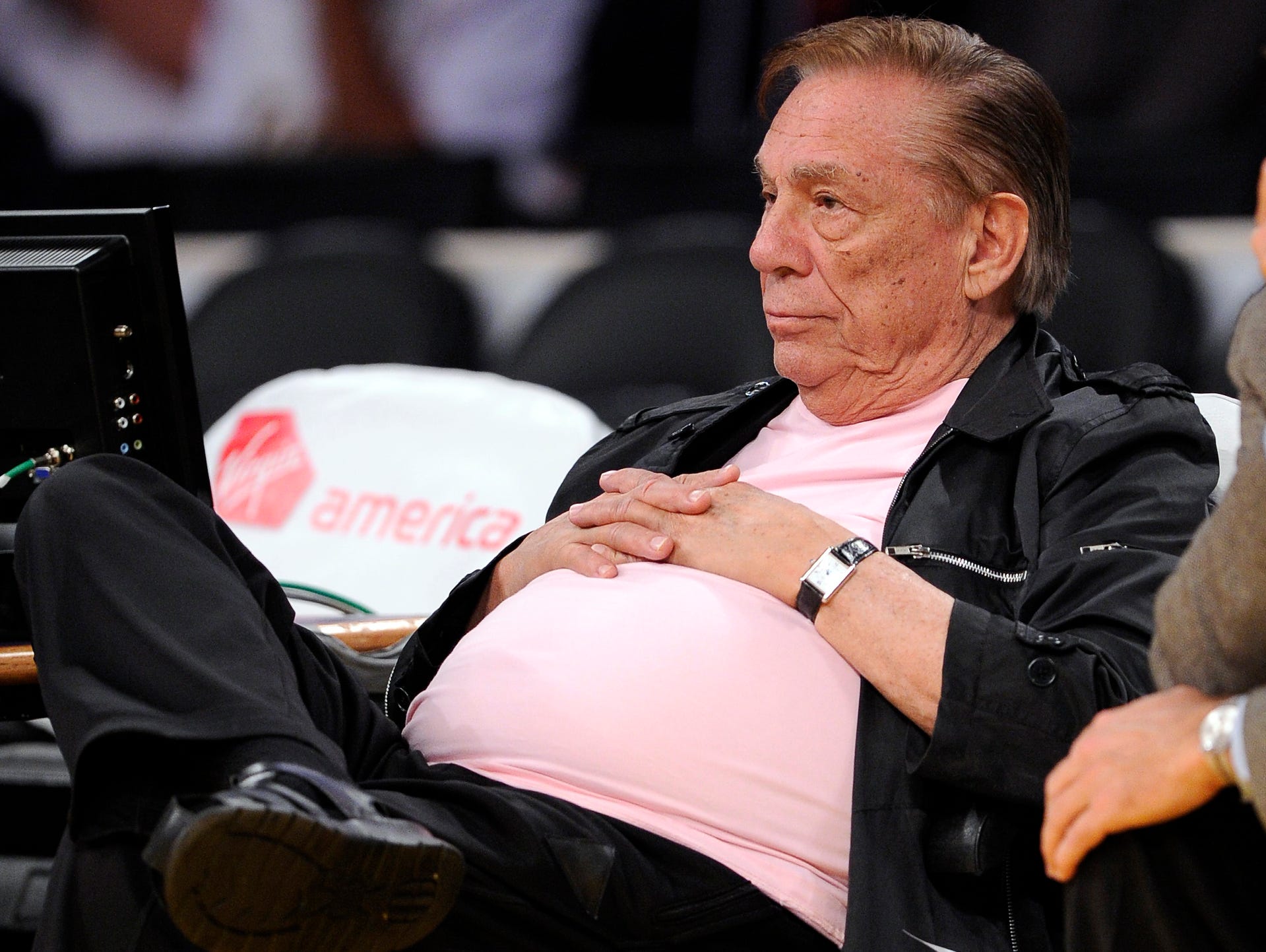

Longtime Clippers owner Donald Sterling, shown in 2010, has been banned by the NBA. Flip through this gallery for more of Sterling. Mark J. Terrill, APFullscreen

Longtime Clippers owner Donald Sterling, shown in 2010, has been banned by the NBA. Flip through this gallery for more of Sterling. Mark J. Terrill, APFullscreen Sterling and former Los Angeles mayor Tom Bradley pose for a photo in 1987. Andrew D. Bernstein, NBAE/Getty ImagesFullscreen

Sterling and former Los Angeles mayor Tom Bradley pose for a photo in 1987. Andrew D. Bernstein, NBAE/Getty ImagesFullscreen A portrait of Sterling, who also is a real estate entrepreneur, as he holds a mug and stands near a deck chair in Malibu, Calif., June 1989. Rob Lewine, Time & Life Pictures/Getty ImageFullscreen

A portrait of Sterling, who also is a real estate entrepreneur, as he holds a mug and stands near a deck chair in Malibu, Calif., June 1989. Rob Lewine, Time & Life Pictures/Getty ImageFullscreen Sterling sits courtside during a game in 2010. Danny Moloshok, APFullscreen

Sterling sits courtside during a game in 2010. Danny Moloshok, APFullscreen Sterling and LaLa Vazquez sit next to each other at a Clippers-Nuggets playoff game, where Vazquez's future husband, Carmelo Anthony, starred for Denver. Garrett Ellwood, NBAE/Getty ImagesFullscreen

Sterling and LaLa Vazquez sit next to each other at a Clippers-Nuggets playoff game, where Vazquez's future husband, Carmelo Anthony, starred for Denver. Garrett Ellwood, NBAE/Getty ImagesFullscreen Sterling and former GM Elgin Baylor pose after Baylor, who later sued the team for wrongful termination, won the 2005-06 NBA Executive of the Year Award. Andrew D. Bernstein, NBAE/Getty ImagesFullscreen

Sterling and former GM Elgin Baylor pose after Baylor, who later sued the team for wrongful termination, won the 2005-06 NBA Executive of the Year Award. Andrew D. Bernstein, NBAE/Getty ImagesFullscreen Sterling smiles during the first round of the 2012 playoffs, when the Clippers beat the Grizzlies. Jayne Kamin-Oncea, USA TODAY SportsFullscreen

Sterling smiles during the first round of the 2012 playoffs, when the Clippers beat the Grizzlies. Jayne Kamin-Oncea, USA TODAY SportsFullscreen Sterling and wife Shelly attend a game in November 2013. Kirby Lee, USA TODAY SportsFullscreen

Sterling and wife Shelly attend a game in November 2013. Kirby Lee, USA TODAY SportsFullscreen Sterling sits courtside at a December 2012 game. Jayne Kamin-Oncea, USA TODAY SportsFullscreen

Sterling sits courtside at a December 2012 game. Jayne Kamin-Oncea, USA TODAY SportsFullscreen Sterling greets fans during December 2012. Jayne Kamin-Oncea, USA TODAY SportsFullscreen

Sterling greets fans during December 2012. Jayne Kamin-Oncea, USA TODAY SportsFullscreen Sterling takes in player introductions during the 1997 playoffs, when his team lost to the Jazz. Robert Hanashiro, USA TODAY SportsFullscreen

Sterling takes in player introductions during the 1997 playoffs, when his team lost to the Jazz. Robert Hanashiro, USA TODAY SportsFullscreen Sterling has a laugh with former Clippers star Elton Brand in 2001. Catherine Steenkeste, NBAE/Getty ImagesFullscreen

Sterling has a laugh with former Clippers star Elton Brand in 2001. Catherine Steenkeste, NBAE/Getty ImagesFullscreen Sterling talks with former Clippers star Lamar Odom before a 2000 game. Robert Hanashiro, USA TODAY SportsFullscreen

Sterling talks with former Clippers star Lamar Odom before a 2000 game. Robert Hanashiro, USA TODAY SportsFullscreen Sterling and former NBA commissioner David Stern meet with officials before a Clippers 2012 second-round playoff game vs. the Spurs. Jayne Kamin-Oncea, USA TODAY SportsFullscreen

Sterling and former NBA commissioner David Stern meet with officials before a Clippers 2012 second-round playoff game vs. the Spurs. Jayne Kamin-Oncea, USA TODAY SportsFullscreen Sterling and wife Shelly pose for a photo before a 2012 playoff game. Andrew D. Bernstein NBAE/Getty ImagesFullscreen

Sterling and wife Shelly pose for a photo before a 2012 playoff game. Andrew D. Bernstein NBAE/Getty ImagesFullscreen Sterling during the 2012 NBA playoffs. Jayne Kamin-Oncea, USA TODAY SportsFullscreen

Sterling during the 2012 NBA playoffs. Jayne Kamin-Oncea, USA TODAY SportsFullscreen Sterling in Nov. 2012. Mark J. Terrill, APFullscreenLike this topic? You may also like these photo galleries:Replay

Sterling in Nov. 2012. Mark J. Terrill, APFullscreenLike this topic? You may also like these photo galleries:Replay