Chances are your luxury car has its sound system or infotainment package from the sound system extraordinaire Harman International Industries (HAR) company. We believe that Harman operates in a niche field that has impressive exposure to the rebounding auto industry.

The company is in semi-turnaround mode after a very weak 2009. We believe that its operating metrics are rebounding nicely, but its valuation still lags. The company not only has a stronghold on the audio car part market, but it's also breaking into the mobile phone market and tapping emerging markets. With its expanding operating margin and robust revenue growth we see nearly 80% upside to the stock.

Company overview

The company is the leader in sound systems for luxury automobiles with an 80% market share. Its brands include AKG, Harman/Kardon, Infinity, JBL, Lexicon and Mark Levinson. Outside of the car, Harman's products are found in home entertainment systems, theaters, live entertainment venues and recording studios. The company operates via three segments, infotainment, lifestyle and professional, with infotainment being its key segment, accounting for over 50% of revenues. This is key considering the fact that the bustling and rebounding auto market should spur Harman's revenues higher.

(click to enlarge)

Corporate & Industry Overview

Harman International has manufacturing facilities in North America, Europe, Asia and South America.Harman has a history of innovation with 300 new patents filed in the first 9 months of the 2013 fiscal year. This brings the total patent count to more than 4,600.In the past 3 years, Harman International has spent a combined $959.2 million on research and development.74% of the company's sales came from automobile manufacturers.At the end of June 2012, estimate awarded business for Harman International was $16.1 billion.None of its automobile customers are obl! igated to long-term purchase agreements.The audio market is highly competitive and fragmented.The company's two largest markets are the U.S. and Germany.Industry Tailwinds

Auto sales have staged a dramatic comeback since the depths of the financial crisis. Sales have been steadily recovering over the past few years and 2013 is shaping up to be a great year. In the following table, we can see how sales have improved over 2012 levels.

Key takeaways include the fact that all the major categories (cars, light-duty trucks, SUVs, crossovers) have seen very robust growth both YTD and for the month of June.

June 2013 | % Change From June 2012 | YTD 2013 | % Change From YTD 2012 | |

Cars | 708,645 | +7.5 | 3,993,403 | +4.5 |

Midsize | 333,515 | +0.6 | 1,903,259 | (1.0) |

Small | 276,200 | +16.1 | 1,542,684 | +10.8 |

Luxury | 98,414 | +10.1 | 545,899 | +8.4 |

Large | 516 | (12.1) | 1,561 | (66.8) |

Light-duty trucks | 695,789 | +11.1 | 3,835,738 | +11.2 |

Pickup | 191,664 | +17.8 | 1,065,360 | +15.1 |

Crossover | 300,442 | +10.2 | 1,658,687 | +13.1 |

Minivan | 81,355 | +7.3 | 414,960 | (2.5) |

Midsize SUV | 69,107 | +13.5 | 389,303 | +12.7 |

Larg! e SUV ! | 18,717 | (16.4) | 121,144 | +7.9 |

Small SUV | 21,068 | +9.9 | 107,414 | +9.1 |

Luxury SUV | 13,436 | +7.9 | 78,870 | +3.0 |

Total SUV/Crossover | 422,770 | +9.1 | 2,355,418 | +12.2 |

Total SUV | 122,328 | +6.5 | 696,731 | +10.1 |

Total Cross-over | 300,442 | +10.2 | 1,658,687 | +13.1 |

Source: motorintelligence.com

Total vehicle sales were up 9% in June to 1.4 million vehicles. The improving housing market is also lending support to the auto recovery. Vehicle sales for General Motors (GM), Ford (F) and Toyota (TM) blew past expectations. The head of U.S. sales for GM Kurt McNeil said on a conference call after sales numbers were released:

American families are better off than they were at the beginning of the year. They also believe that the economic expansion is going to continue, so they're buying more homes, and more cars and trucks.

In looking at the market, Harman has several privately-held competitors including Bose Corporation and Bosch Group. On the public side, Harman competes with Panasonic (PCRFY.OB), Delphi Automotive (DLPH), and Visteon (VC).

Harman | Panasonic | Delphi | Visteon | |

Market Cap | $3.81 billion | $20.41 billion | $17.18 billion | $3.26 billion |

Employees | 11,366 | 293,742 | 118,000 | 23,000 |

Revenue | $4.21 billion | $92.80 ! billion | $15.45 billion | $7.00 billion |

Gross Margin | 0.27 | 0.26 | 0.17 | 0.09 |

EBITDA | $408.41 million | $6.36 billion | $2.12 billion | $510.00 million |

Operating Margin | 0.07 | 0.02 | 0.10 | 0.04 |

Net Income | $186.18 million | ($9.58 billion) | $1.01 billion | $204.00 million |

P/E | 21.11 | N/A | 17.37 | 17.65 |

Price/Sales | 0.90 | 0.22 | 1.11 | 0.46 |

Company Tailwinds

Harman is coming off a solid fiscal Q3 with relatively flat sales, but a big improvement in the bottom line as the company continues to execute its operational and cost management programs. EBITDA improved by 100 basis points to 9.2%. All three divisions posted higher profitability quarter-over-quarter. EPS improved from $0.59 in Q2 to $0.79 for Q3.

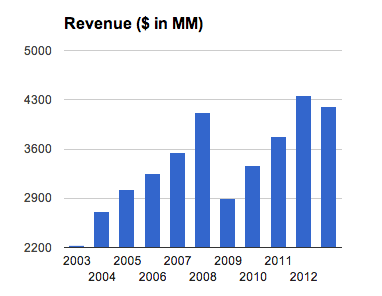

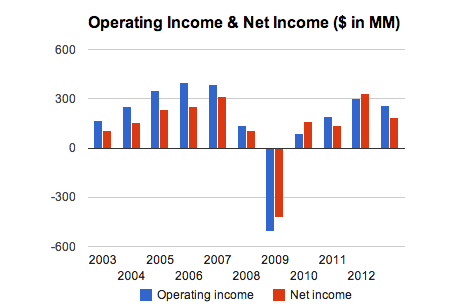

The company raised full-year guidance for fiscal 2013 to $3.00 in EPS. Previous expectations were for EPS of $2.70 to $2.90. EPS last year was $2.93. Full-year sales are expected to be between $4.175 billion and $4.25 billion. Last year revenues were $4.21 billion. While all this sounds great, it gets even better when considering the turnaround Harman has managed. 2009 was particularly rough for the company; sales plummeted and income fell negative.

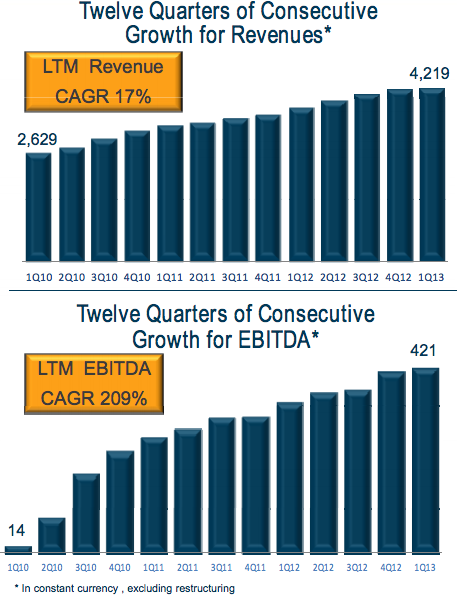

Things get even more impressive if we take a more "zoomed in" look into Harman's financials. The company has managed to grow rev! enues and! EBITDA for twelve consecutive quarters.

Harman is also returning more cash to shareholders. The company just doubled the annual dividend payout to $1.20 per share. The yield is now 2.2% and increases the company's appeal to income investors. Harman also increased its share repurchase authorization by $200 million. The company had $70 million remaining on its previous authorization and the $200 million will be in addition to the previous authorization.

Harman can afford to return more cash to shareholders with its strong financials. More than 50% of the company's debt doesn't mature until after fiscal 2017 and beyond. On the balance sheet, there's $434.24 million in cash and $294.37 million in cash. The dividend payout ratio is now 40%. Operating cash flow last year was $198.33 million.

Growth Strategy

Harman Kardon is always looking to stay one step ahead of its competition. The company is focused on the next generation of audio and infotainment systems. The plan is to combine the latest technology in wireless networking, streaming audio, hands-free connectivity, driver assistance and safety systems. By combining all these features, Harman can continue growing its business with the auto manufacturers.

To do so, Harman has partnered with Apple (AAPL) and its Siri technology in the new Ferrari FF. Apple choosing to partner with Harman illustrates how strong Harman's brand is in the audio space. Voice-control and activation is the next wave in the car infotainment space.

Harman is also expanding its distribution channels in the home entertainment and multimedia markets. Harman has partnered with Sprint (S) and is selling Harman multimedia products in more than 1,000 Sprint stores. Harman is also entering into a distribution relationship with both Verizon (VZ) and AT&T (T) to distribute in their stores as well.

In the past 6 months, Harman has sold more than 1 mil! lion wire! less portable audio products. The company's recently launched JBL Flip was listed by The NPD Group as the top-selling portable audio product in its category in the U.S.

Harman is also aggressively expanding into emerging markets. The company is particularly active in Brazil, Russia, India and China where it has dedicated country managers for each country. Harman is also expanding its research and development, production capabilities, and distribution channels for these markets.

A big focus for Harman is in China where it already has two factories and is considering building a third. Harman is looking to expand its presence in China and reduce its reliance on Europe where the auto market continues to contract. Harman so far has invested $200 million in its businesses in China and seen sales grow from $20 million four years ago to $400 million last year. CEO Dinesh Paliwal told Bloomberg at the Fortune Global Forum in Chengdu, China:

I'm extremely bullish on China. Next five years for China, we'll more than double, triple our business here.

In China, the company just entered the fast-growing Karaoke Television market. It's currently a $500 million market and growing rapidly. Harman already has orders for several million dollars, up from zero just recently.

Valuation

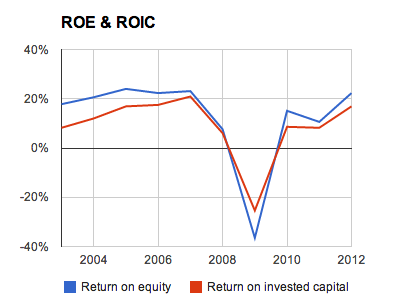

What we really love about the stock is that it might not be too late to get into the stock. Meaning the company's valuation and price is lagging the company's performance and industry tailwinds. The company's income is returning to pre-2009 levels, and return on capital and return on invested capital is trending higher.

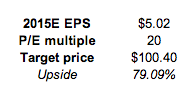

We believe that the future remains bright for the company. It's expected to see revenues increase across the board, while also being able to expand margins. This should help the company reach EPS of over $5.

(click to enlarge)

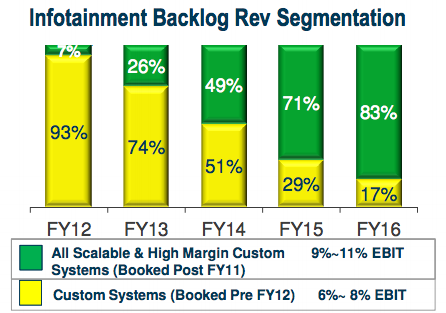

Being one of the key drivers for this impressive EPS growth will be strong revenue growth and margin expansion of its infotainment segment. By fiscal 2016, the company expects 83% of its backlog revenue to be scalable systems (EBIT margin 9% to 11%), versus 7% of backlog in fiscal 2012. Custom solutions made up 93% of backlog in 2012 and the average EBIT margin is between 6% and 8%.

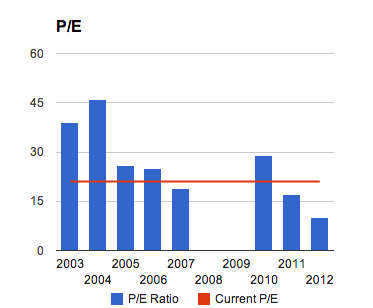

Based on our EPS estimates, Harman is trading at 14x 2014 EPS and only 11x 2015 EPS. However, with operating metrics returning to previous levels, shouldn't the company be afforded an appropriate valuation multiple that's indicative of its future performance? At its current 20x P/E, the company is trading below pre-2009 levels...

...and at its 11x forward (2015 EPS) P/E, the company is ridiculously below historical standards and major car-part manufacturers Delphi and Visteon, which trade between 17x and 18x. Assuming that Harman should trade closer to 20x, the upside for 2015 is nearly 80%.

Investment Thesis

The greatest asset and the reason for owning Harman International is its brand, its reputation and its quality products. The biggest risks to owning Harman is the cyclicality of the auto business and that its customers are now bound to long-term contracts. A loss of business from BMW, Audi, Mercedes, or another big auto company would be a serious blow to Harman. However, we do think it's unlikely as Harman has the best audio and infotainment products in the market.

The company has a number of tailwinds that should help the market recognize its undervaluing and afford it a more appropriate valuation multiple. This includes the start of production of next generati! on infota! inment solution for Mercedes S-Class, integrating Apple's SIRI into Harman's headunit in Ferrari's FF infotainment system, and full integration of its iOnRoad acquisition for enhancing vehicle safety

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment