Nadex Spreads are completely different than Nadex Binaries and determining the moneyness for them is also different. Though the definition for moneyness has the same meaning as the intrinsic value of the option, it is also effected by how close the spread is to the underlying market, or the proximity to the underlying market.

Below is a Nadex spread for EUR/USD with the underlying being the EUR/USD Spot Forex. As can be seen, the floor of the spread is 1.3530 and the ceiling is 1.3630. If a trader buys this spread, they are long and the distance between the entry price and the ceiling is the max profit. The distance between the entry and the floor is the max risk.

Related Link: How To Determine Intrinsic Value Of A Nadex Binary Option

A trader cannot have additional loss should the market fall below the floor or additional profit should the market move above the ceiling. The profits and losses are limited to the ceiling and floor levels respectively. How can the moneyness of this spread be determined? To do so, one needs to know where the underlying market is in relation to the spread floor and ceiling and whether the position is long or short.

To view image click HERE

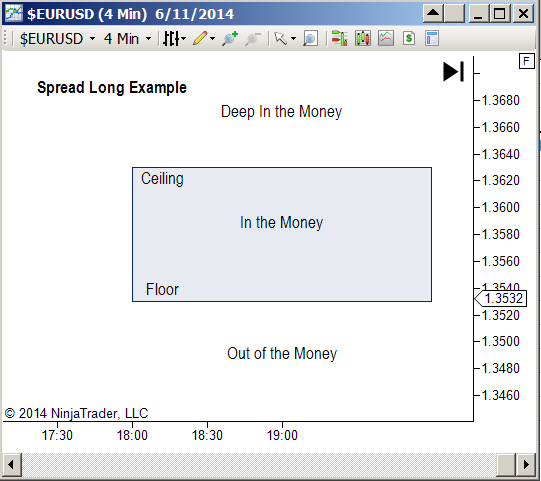

Assume for now that a trader bought this spread. Also assume the underlying market is trading around 1.3657. The market has moved 27 ticks above the ceiling price of this spread. This spread currently would be what is called “deep in the market”, “deep in the money”, “deep in the spread” or “D” for short. What if the underlying price were in between the spread floor and ceiling at 1.3580? Then the spread would be “in the market”, “in the money”, “in the spread” or “I” for short. Finally, what if the underlying fell below this spreads’ floor? Then the spread would be “out of the market”, “out of the money”, “out of the spread” or “O” for short.

The chart below shows a visual of where the underlying market floor and ceiling levels are, as well as where price would have to be to be considered deep in the money, in the money or out of the money, if a trader were long on this spread.

To view image click HERE

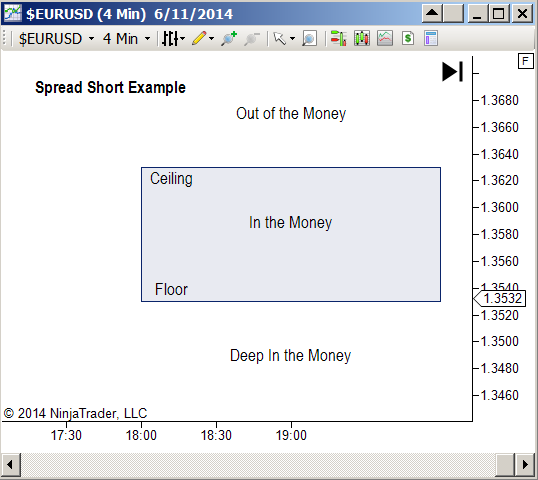

What if a trader went short on the same spread? Then they moneyness is reversed. If the underlying market was below the floor, then the spread would be deep in the market. If the underlying were in between the floor and the ceiling, then the spread would be in the market. If the underlying were above the ceiling, then the spread would be out of the market. This can be seen in the chart below.

To view image click HERE

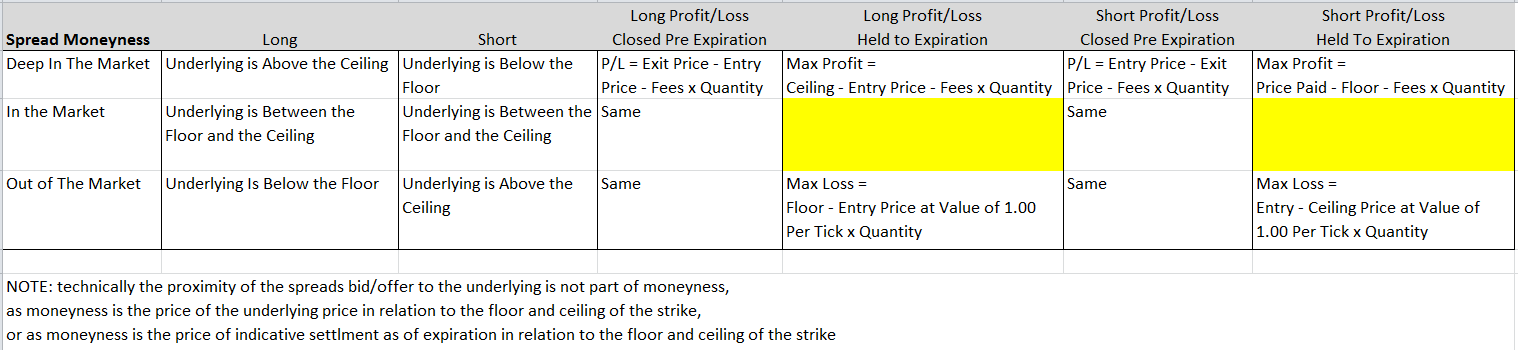

How can traders figure profit and loss in relation to the moneyness of a spread? To figure max profit on a spread if a trader were long, it would be the distance between the entry price and the ceiling. The max loss would be the distance between the entry price and the floor.

To figure max profit on a spread held short, it would be the distance between the entry and the floor. The max loss would be the distance between the entry price and the ceiling. Take a look at the chart below for complete formulas on how to calculate profit and loss, including fees and quantity, depending on if a position is long or short and where the trade closed.

To view image click HERE

For more information on Nadex binaries and spreads and how to trade them and get access to the free binary and spread scanners, go to www.apexinvesting.com. To practice trading binaries and spreads on a free demo account, go to www.nadex.com and click on trading demo, trading account. Apex Investing Institute offers free education, effective tools and a room community of seasoned as well as up-and-coming traders. Together in a supportive environment, along with tools to trade with ease and convenience, traders of all levels can learn ho

No comments:

Post a Comment