DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for under $10 a share don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Must Read: Warren Buffett's Top 10 Dividend Stocks

Just take a look at some of the big movers in the under-$10 complex on Friday, including IsoRay (ISR), which is ripping higher by 25%; Amedica (AMDA), which is exploding higher by 19%; Alpha Pro Tech (APT), which is spiking higher by 13%; and Aehr Test Systems (AEHR), which is moving to the upside by 13%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Must Read: 10 Stocks Billionaire John Paulson Loves in 2014

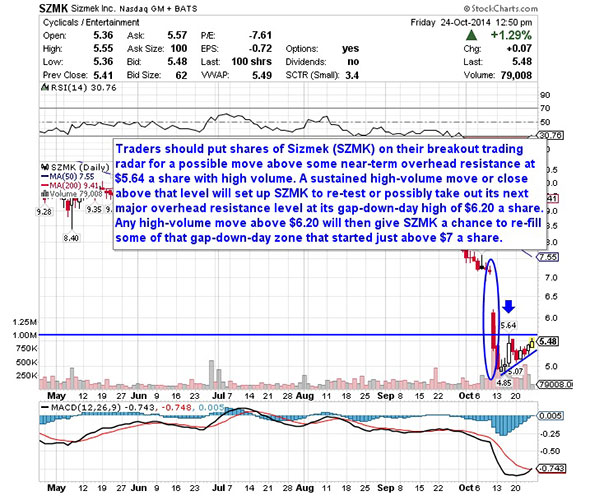

Sizmek

One under-$10 advertising player that's starting to trend within range of triggering a major breakout trade is Sizmek (SZMK), which provides online advertising delivery and optimization services worldwide. This stock has been destroyed by the sellers so far in 2014, with shares off sharply by 46%.

If you take a glance at the chart for Sizmek, you'll see that this stock has been downtrending badly for the last four months, with shares plunging lower from its high of $10.20 to its new 52-week low of $4.85 a share. During that move, shares of SZMK were consistently making lower highs and lower lows, which is bearish technical price action. This stock also gapped down sharply a few weeks ago from over $7 to under $5.50 with heavy downside volume. Following that move, shares of SZMK have started to rebound off that $4.85 low and it has now started to uptrend a bit. That move is quickly pushing shares of SZMK within range of triggering a big breakout trade.

Traders should now look for long-biased trades in SZMK if it manages to break out above some near-term overhead resistance at $5.64 a share with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action of 177,312 shares. If that breakout develops soon, then SZMK will set up to re-test or possibly take out its next major overhead resistance level at its gap-down-day high of $6.20 a share. Any high-volume move above $6.20 will then give SZMK a chance to re-fill some of that gap-down-day zone that started just above $7 a share.

Traders can look to buy SZMK off weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support at $5.07 a share or around its 52-week low of $4.85 a share. One can also buy SZMK off strength once it starts to take out $5.64 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 5 Stocks Insiders Love Right Now

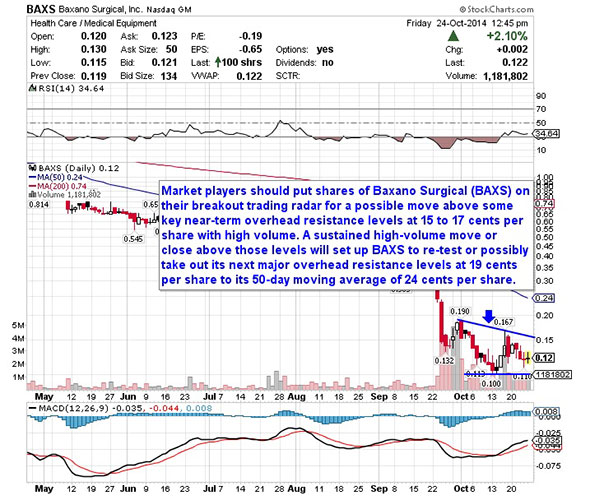

Baxano Surgical

Another under-$10 medical device player that's setting up to break out here is Baxano Surgical (BAXS), which designs, develops and markets minimally invasive products to treat degenerative conditions of the spine affecting the lumbar region. This stock has been decimated by the sellers so far in 2014, with shares down huge by 87%.

If you take a look at the chart for Baxano Surgical, you'll notice that this stock has started to form a potential major bottoming chart pattern over the last month, with shares finding buying interest right above or around 10 cents per share. This pattern is starting to emerge after shares of BAXS saw some extreme downside volatility in late September, when the stock plunged in just a few trading sessions from over 30 cents per share to around 13 cents per share. Shares of BAXS are now starting to spike higher off those near-term support levels and it's starting to move within range of triggering a major breakout trade above a key downtrend line.

Market players should now look for long-biased trades in BAXS if it manages to break out above some key near-term overhead resistance levels at 15 cents per share to 17 cents per share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 899,211 shares. If that breakout triggers soon, then BAXS will set up to re-test or possibly take out its next major overhead resistance levels at 19 cents per share to its 50-day moving average of 24 cents per share.

Traders can look to buy BAXS off weakness to anticipate that breakout and simply use a stop that sits right below its 52-week low of 10 cents per share. One can also buy BAXS off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: Sell These 5 Toxic Stock Before November

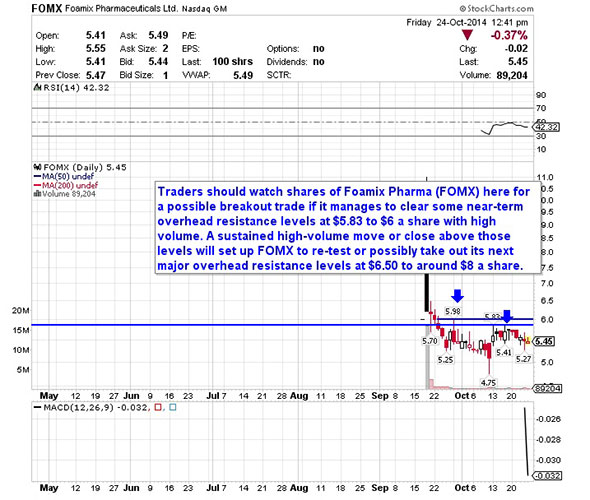

Foamix Pharmaceuticals

One under-$10 specialty pharmaceutical player that's starting to move within range of triggering a near-term breakout trade is Foamix Pharmaceuticals (FOMX), which develops and commercializes foam-based formulations acne, impetigo, and other skin conditions. This stock is off notably so far in 2014, with shares down by 11.5%.

If you take a glance at the chart for Foamix Pharmaceuticals you'll notice that this stock has been trending sideways and consolidating for the last month, with shares moving between $4.75 on the downside and around $6 on the upside. Shares of FOMX have now started to spike higher right above that $4.75 low and it's quickly pushing within range of triggering a near-term breakout trade above the upper-end of its recent sideways trading chart pattern.

Traders should now look for long-biased trades in FOMX if it manages to break out above some near-term overhead resistance levels at $5.83 to $6 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 919,488 shares. If that breakout develops soon, then FOMX will set up to re-test or possibly take out its next major overhead resistance levels at $6.50 to around $8 a share.

Traders can look to buy FOMX off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $5.27 a share or around its all-time low of $4.75 a share. One can also buy FOMX off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 7 Stocks Warren Buffett Is Selling in 2014

Arcos Dorados

Another under-$10 restaurant player that's starting to move within range of triggering a major breakout trade is Arcos Dorados (ARCO), which is an Argentina-based company engaged in the operation of McDonald's franchisees. This stock has been destroyed by the sellers so far in 2014, with shares off dramatically by 49%.

If you look at the chart for Arcos Dorados, you'll notice that this stock has started to uptrend over the last few weeks, with shares moving higher from its low of $5.40 to its recent high of $6.38 a share. During that move, shares of ARCO have been making mostly higher lows and higher highs which is bullish technical price action. This move has started to emerge after shares of ARCO were downtrending badly over the last four months, with the stock plunging from its high of $11.32 to its new 52-week low of $5.40 a share. This near-term stabilization and slight uptrend for ARCO could be signaling that an overall trend change is shaping up. Plus, shares of ARCO are starting to move within range of triggering a big breakout trade.

Market players should now look for long-biased trades in ARCO if it manages to break out above some near-term overhead resistance levels at $6.38 to $6.41 a share and then above its 50-day moving average of $6.44 a share to more key near-term resistance at $7 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 813,532 shares. If that breakout develops soon, then ARCO will set up to re-test or possibly take out its next major overhead resistance level at $8 to its 200-day moving average of $8.79 a share.

Traders can look to buy ARCO off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $5.80 a share or right around its 52-week low of $5.40 a share. One can also buy ARCO off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

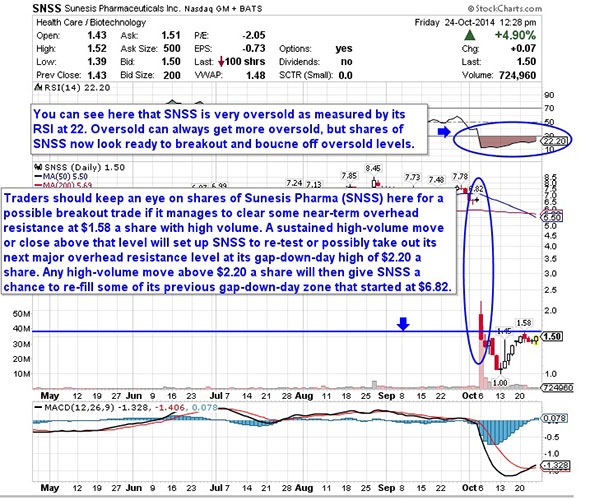

Sunesis Pharmaceuticals

An under-$10 biopharmaceutical player that's quickly moving within range of triggering a big breakout trade is Sunesis Pharmaceutical (SNSS), which focuses on the development and commercialization of oncology therapeutics for the treatment of solid and hematologic cancers. This stock has been destroyed by the sellers so far in 2014, with shares down sharply by 71%.

If you take a glance at the chart for Sunesis Pharmaceuticals, you'll see that this stock recently gapped down sharply from $6.82 a share to below $1.50 a share with monster downside volume. Following that move, shares of SNSS continued to slide lower with the stock making a new 52-week low at $1 a share. That massive collapse in the share price for SNSS has now pushed the stock into extremely oversold territory, since its current relative strength index reading is 22. Oversold can always get more oversold, but shares of SNSS have already started to rebound off at $1 low and it's now quickly moving within range of triggering a big breakout trade.

Traders should now look for long-biased trades in SNSS if it manages to break out above some near-term overhead resistance at $1.58 a share with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action 2.11 million shares. If that breakout materializes soon, then SNSS will set up re-test or possibly take out its next major overhead resistance level at its gap-down-day high of $2.20 a share. Any high-volume move above $2.20 a share will then give SNSS a chance to re-fill some of its previous gap-down-day zone that started at $6.82 a share.

Traders can look to buy SNSS off weakness to anticipate that breakout and simply use a stop that sits right around $1.30 to $1.25 a share. One can also buy SNSS off strength once it starts to take out $1.58 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>How to Trade the Market's Most-Active Stocks

>>Book Double the Gains With These Shareholder Yield Champs

>>4 Stocks Spiking on Big Volume

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment