BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>Buy These 5 Rocket Stocks to Beat the Market

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Blue-Chip Stocks to Trade for Gains

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Micros Systems

Nearest Resistance: $68

Nearest Support: $67.80

Catalyst: Acquisition News

Shares of Micros Systems (MCRS) are up 3.4% this afternoon, following news that Oracle (ORCL) was planning on buying the mid-cap tech name for $68 per share. The news doesn't come as a total shock for shareholders of MCRS -- the rumor mill got this acquisition deal right earlier in the month, though the final numbers didn't hit until today.

Ultimately, the money has already been made on this name; shares of MCRS are sitting right below their $68 offer price this afternoon, a level that's acting like a fundamental resistance price for shares. If you didn't own MCRS before today, don't bother being a buyer here.

Oracle

Nearest Resistance: $42

Nearest Support: $40

Catalyst: MCRS Acquisition

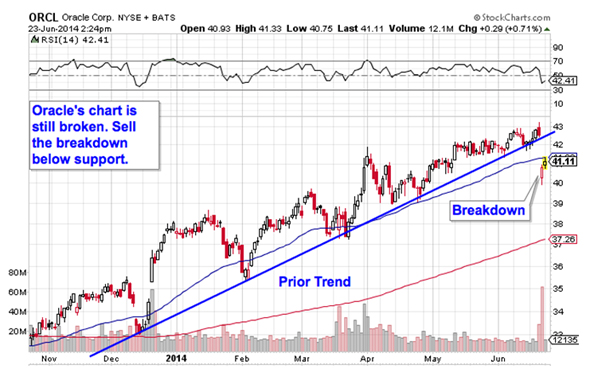

The other side of the Micros Systems acquisition is Oracle, the enterprise software giant that's buying the smaller firm. Oracle's meaningful price action came at the end of last week with a conspicuous earnings miss. The miss was bad enough to shove shares down below the bottom of the uptrend that's been in play in shares since back in December.

Micros buy or not, Oracle's chart is broken right now.

Advanced Micro Devices

Nearest Resistance: $4

Nearest Support: $3.70

Catalyst: Analyst Downgrade

Chip company Advanced Micro Devices (AMD) is down for a second straight day today, off just over 3% this afternoon following an analyst downgrade. AMD got sold off on Friday following news that high graphics card inventories could hamper sales in the quarter ahead, but today's downgrade by Pacific Crest is adding insult to injury for this mid-cap processor maker. Pacific Crest lowered AMD to "underperform".

Technically speaking, AMD is in "make or break mode" right now. Shares have been bouncing their way higher in a well-defined uptrend, but today's drop is threatening a breakdown below trendline support. If shares close below that lower trendline, it makes sense to join the sellers.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Hated Earnings Stocks You Should Love

>>3 Stocks Spiking on Unusual Volume

>>5 Stocks Setting Up to Break Out

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment