BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Hated Earnings Stocks You Should Love

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>Where's the S&P Headed From Here? Higher!

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. That's especially true now that earnings season is officially underway. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

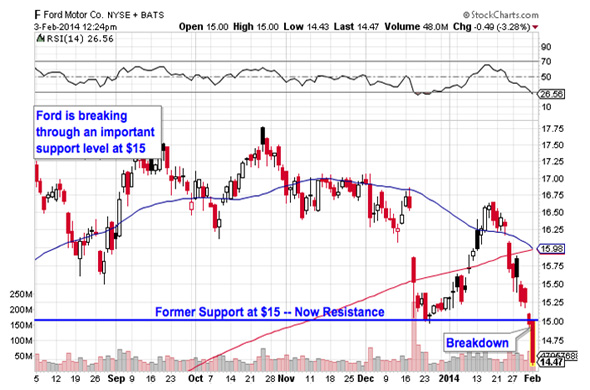

Ford

Nearest Resistance: $15

Nearest Support: $13

Catalyst: January Sales Miss

>>5 Rocket Stocks to Buy in February

Shares of Detroit automaker Ford (F) are off more than 3% on high volume this afternoon, the reaction from a January sales miss that registered 7% lower vs. last year's particularly strong reading. Ford attributed the miss to inclement weather in the brand's biggest sales regions.

One silver lining came from Lincoln, the premium brand that's been struggling to find its way in recent years. Lincoln saw its strongest sales in four years.

Still, Ford looks bearish overall today. More significantly, today's 3% selloff is pushing shares through an important support level at $15. With buyers unable to keep up with supply of shares at that level, look out below for more downside in Ford in February.

AT&T

Nearest Resistance: $33.50

Nearest Support: $32.25

Catalyst: Price Cuts

>>5 Big Trades to Profit During the Fed's QE Pay Cut

Telecom giant AT&T (T) is another name that's down more than 3% this afternoon, in this case because of an escalating war between the firm and its ultra-competitive rivals. AT&T announced that it was cutting the monthly fee for family data plans on Saturday, a move that could spur rival carriers into reacting with cuts in kind. While the move was designed to retain customers amid commoditized service offerings, it's also going to negatively impact AT&T's margins in 2014.

The technical story in AT&T isn't far off from Ford's setup. Shares of T are testing a key support level at $32.35 in today's session, a support level that, if broken, spells a lot more downside ahead. AT&T's chart has been broken for a while now, but it's getting worse. Don't buy the dip in this communications giant.

Radio Shack

Nearest Resistance: $2.70

Nearest Support: $2.40

Catalyst: Super Bowl Ad

Electronics retailer Radio Shack (RSH) is moving higher on abnormal volume after -- of all things -- a funny Super Bowl ad. I wish I were making that up. Indeed, RSH is more than 4% higher on today's session thanks to the ad, which lampooned the store for its '80s vibes -- and reintroduced the new Radio Shack store concept.

Part of the move higher this afternoon comes from a stock that started off with pretty attractive technicals to begin with. RSH has been looking "bottomy" lately, with an inverse head and shoulders setup forming in shares since December. The buy signal comes on a push through the $2.70 level.

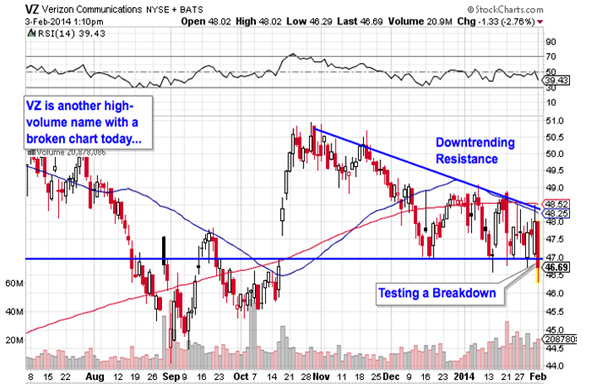

Verizon

Nearest Resistance: $47

Nearest Support: $45.50

Catalyst: AT&T Price Cuts

>>5 Stocks With Big Insider Buying

Last up is Verizon (VZ), a name that's off 2.7% this afternoon because of AT&T's decision to cut prices. Investors are selling shares on fears that AT&T just ignited a race to the bottom on data charges, a change that would be great for consumers -- and horrific for VZ's bottom line. Whatever the outcome, Verizon's technical story looks sketchy right now.

Shares are pushing through support at $47 this afternoon. If the breakdown holds into today's close, the next-closest support level is down at $45.50. It makes sense to stay away from VZ unless it can catch some semblance of support again.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Spiking on Unusual Volume

>>5 Short-Squeeze Stocks That Could Pop in February

>>2 Stocks Under $10 Moving Higher

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment