We are seeing more and more computer glitches as it relates to the systems in place to manage America's financial system. We have had issues in individual stocks, at various trading companies, even at exchanges themselves on numerous occasions, but now we find out that the U.S. government is having glitches too. The Wall Street Journal reports (see article here) that Goldman Sachs saw a multi-billion dollar bid not taken for a Treasury auction and received no allocation for that bid. Obviously that resulted in less demand for the issue and could have impacted rates, etc.

These issues need to get fixed and maybe it is time that the SEC opened up an IT department to oversee the vast network of computer systems and programs which keep the world's financial capital running.

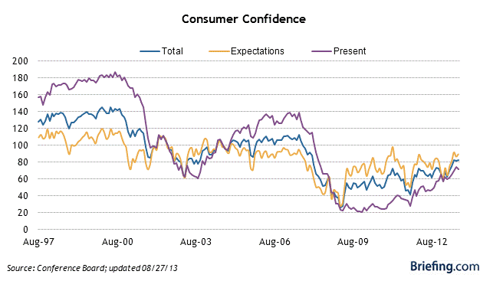

Chart of the Day:

The bottom chart kind of tells the entire story of the current economic situation. Consumers when asked feel better about the present than they did in recent months, but their outlook remains dim because of all of the uncertainty. Until that changes, growth will continue to be slow.

(Click to enlarge)

Source: Briefing

We have no economic news today.

Asian markets finished lower today:

All Ordinaries -- down 0.34%% Shanghai Composite -- CLOSED Nikkei 225 -- down 0.16% NZSE 50 -- down 0.48% Seoul Composite -- CLOSEDIn Europe, markets are higher this morning:

CAC 40 -- up 0.10% DAX -- up 0.14% FTSE 100 -- down 0.04% OSE -- up 0.28%Retail

The big names involved in J.C. Penney (JCP) have changed a lot in the past few months and now Vornado Realty Trust has sold the remaining shares they held from the original position they had in J.C. Penney. This is news, but not all that surprising when one considers that the company had already backed away from the investment in a considerable way earlier this year and had indica! ted their unhappiness with the company. We still dislike the idea of readers investing directly into the name as the risk is still high, but the one thing we would watch is to see if any more big names step into the stock with a bullish stance.

We have long been bullish all things housing and the theme has paid off for readers quite well. It did not get past U.S. though that Pier 1 Imports (PIR) had disappointing numbers yesterday which caused the shares to decline by nearly 14% and volume to spike to 14.6 million shares. The company is still seeing sales growth, but this quarter saw a miss versus Wall Street's consensus numbers. During the conference call management said that the sales issue and profit miss was caused by mismanagement of their advertising which caused store traffic to come in light and forced them to discount merchandise later in the quarter...obviously at steeper discounts than if they had held the sales earlier in the quarter. Full year guidance was lowered, but we are willing to take the same stance here as we did with Bed, Bath & Beyond...a wait and see approach. Still bullish the home goods retailers.

Speaking of subsectors in the retailing industry we are bullish on, how about the drugstores? They all seem to be running on all cylinders and yesterday Rite-Aid (RAD) had a tremendous day. It was the heaviest traded stock on all of the exchanges and saw its shares rise $0.87 (23.45%) to close at $4.58/share. Rite-Aid is the first among the 'Big Three' to report quarterly results so we find it interesting that they saw an increase in same store sales and saw profits driven by generic drugs. We have been told that this is going to be the bottom line driver for the industry via nearly everyone and that it would impact the top line as generics replaced the more expensive branded drugs. We care about earnings growth more than revenue growth, especially when the stall in revenues is due to switching to higher margin product which is purchased for a lower price. The marke! t gets th! is and is pushing all of these names higher. In hindsight we wish we had been more bullish of Rite-Aid earlier, but hindsight is always perfect.

There are a lot of great stories out there in this market, but not too many in the retail sector. Rite-Aid is one of the few though and the drugstore stocks appear poised for more gains moving forward.

(Click to enlarge)

Source: Yahoo Finance

Manufacturing

We did close the trade we had recommended in Tesla (TSLA) recently and when a friend asked U.S. about it and wanted an explanation it led to quite an interesting conversation. As we explained that the company's stock price had increased dramatically and they were working on new stuff that would not be out for a few more years we tried to stress how hard it would be for those new models not to have bugs and other issues. Our friend hit U.S. with a question along the lines of why could the company not be like Apple and string together a couple of big products? He also kindly reminded U.S. that Apple once had the iMac which was followed by the iPod...and if we wanted to see bigger progressions then how about when the company went from iPod to iPhone and then the iPad? It is something we had not really considered in that light, but in that context it does force one to reconsider what expensive is.

Technology

We really dislike fallen internet retail companies, especially those which decide to solve their problems by venturing into new industries/sectors in order to reinvent themselves. The risk is already high with the business model they start out with because margins are razor thin and then they look to use the cash flows from the business which is not working to build a business which is supposed to work. Every time it happens we shake our head and wonder when these guys will learn their lesson.

As far as turnarounds go this! one was ! quick and got the market excited. It has to be an outlier, but we are watching closely as the company tries to be a mini-Amazon.

(Click to enlarge)

Source: Yahoo Finance

Well it seems that Groupon (GRPN) has kind of changed the game with their transformation and turned the company around much faster than we thought possible...assuming that it could be turned around because we were of the thinking that it could not. Although we reversed our bearishness when we perceived that trade having run its course we still had our doubts. The company's reworking of its traditional business, while launching a retailing business and transitioning in new management has erased that negativity and we are going to take this example as a learning experience. Although we were not wrong on a position, it will be a good case study in the event that these transitions become the norm in the business rather than outliers.

Source: Today's Market: Looking Ahead For These Big Movers Based On Recent NewsDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment