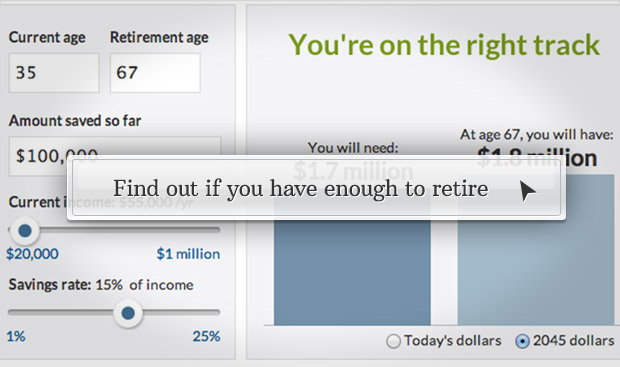

Are you on your way to becoming a 401(k) millionaire? Click the image above to use our retirement calculator.

NEW YORK (CNNMoney) You don't have to make millions to become a 401(k) millionaire.Fidelity Investments analyzed the savings habits of roughly 1,100 401(k) investors who earned less than $150,000 a year and had accumulated more than $1 million in 401(k) savings to determine how they reached the million-dollar mark.

Ultimate Guide to Retirement Getting started401(k)s & company plansInvestingAnnuitiesIRAsSelf-employment plansPensions and benefit plansSocial SecurityInsuranceEstate planningLiving in retirementGetting help How to reach $1 million What's the magic formula to becoming a 401(k) millionaire? Here's what Fidelity recommends.| Start: | At age 25, with a salary of $40,000 that grows 1.5% a year |

| Save: | Either 22% per year at a 5.5% nominal growth rate Or 16% per year at a 7% nominal growth rate |

| Retire: | At age 67, with an ending salary of $73,650 |

The retirement plan provider found these savers, who were an average age of 59, had some key behaviors in common: they started young, always took advantage of the company match and saved a large chunk of their pay each year, a median of 14% (not counting the company match).

These workers put aside a median of $13,300 of their own cash each year and enjoyed a median employer contribution of $4,500, for a total of $17,800 in retirement savings each year.

As a result, the savers grew their median account balance from $426,000 in June 2000 to $1.2 million in June 2012.

"You have to start saving and start saving early," said Jeanne Thompson, Fidelity's vice president for market insights.

A 25-year-old earning $40,000 will need to save more than 20% of her salary each year to hit the million-dollar mark by age 67, assuming her salary grows by 1.5% a year and her investments gain 5.5% annually, according to Fidelity.

While saving $1 million may seem like hitting the retirement jackpot, you may want to hold off on booking that around-the-world cruise.

Take the widely used "4% rule," which dictates you withdraw 4% of your portfolio the first year of retirement and increase that amount each year by the rate of inflation over 30 years. Using that benchma! rk, a $1 million portfolio could provide about $40,000 a year in retirement income for 30 years -- not exactly enough for lavish lifestyle.

To get a basic idea of your savings needs, try a retirement calculator. Generally, you should assume you will need at least 70% of your pre-retirement income. If you were making $100,000 before retirement, for example, you will need at least $70,000 a year from your retirement savings and other income sources like Social Security.

Here are some more tips from the pros.

Start young: Thanks to compounding returns, the fact that your investments' returns will build upon themselves, the money you set aside in your 20s and 30s enjoys a snowball effect.

For example, a single investment of $5,000 would grow to more than $50,000 in 40 years, assuming an average annual return of 6%.

Max out your savings: Most planners recommend socking away at least 10% to 15% of your salary each year. But if you can't afford to do that, make sure to contribute enough to receive your full company match, said Anton Bayer, founder and CEO of Up Capital Management, which works with dozens of 401(k) plans.

Don't be overly conservative: Sticking all your money in "safe" investments is a surefire way to stall your savings potential.

Financial planners say stocks are still the best bet for retirement savers. Bonds or savings accounts simply don't offer high enough returns to grow an adequate nest egg on their own. "If you're 25 years old [those investments] might not get you there, " said Patrick Chu, a Newport Beach, Calif.-based financial planner.

One common rule of thumb to help you determine the percentage of your investments that should be in stocks is to subtract your age from 120. For example, a 35-year-old should have up to 85% of his portfolio in stocks.

Fidelity found that the 401(k) millionaires in their 40s invested 70% of their savings in equities, and earned a median annual return of 4! .8%.

! How I talk to my spouse about retirement

How I talk to my spouse about retirement Keep emotion out of it: Once you've figured out the asset allocation that makes sense for your age and risk tolerance, stick to it. This will keep you from gambling with your savings during market highs or from pulling out during market lows.

Watch out for fees: Over the course of a career, the fees you pay can mean a difference of more than $100,000 in savings.

Index funds, which mirror overall market movements, tend to carry cheaper fees of less than 1%, while actively managed funds can charge twice as much or more. Smaller 401(k) plans tend to have the highest fees, but most plans still have a few cheaper options.

Work as long as you can: Staying on the job longer not only provides additional years to contribute and grow your investments, but it means your savings will need to sustain you through fewer years of retirement.

A 65-year-old with $1 million in his 401(k) can expect his nest egg to provide roughly $71,000 a year throughout a 25-year retirement if he retires at 65, according to Chu. But if he works five more years, investing just $4,000 more a year, and retires at the age of 70, he will be able to live on more than $100,000 a year until age 90, he said. ![]()

No comments:

Post a Comment