Related ES Technical Update: S&P Futures Support And Resistance Technical Update: S&P Futures Support And Resistance

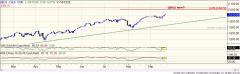

Related ES Technical Update: S&P Futures Support And Resistance Technical Update: S&P Futures Support And Resistance Currently just above 2,000, the S&P futures have flipped the switch back "on" and are back in rally mode, Friday's quiet trading not withstanding.

Technicians are now providing a range of potential upside targets rather than a specific level; last week's update had them indicating that 2057 was the upside ceiling. They are now of the opinion that the "minis" will make it at least up to 2049 and possibly as high as 2066.

From there, they are looking for a pullback in the markets that will take the S&P e-Minis down at least 8 percent to 1861–1868.

Latest Ratings for ES| Feb 2013 | Imperial Capital | Downgrades | Outperform | In-line |

| Jan 2013 | FBR Capital | Downgrades | Outperform | Market Perform |

| Dec 2012 | Wedbush | Maintains | Neutral |

View More Analyst Ratings for ES

View the Latest Analyst Ratings

Posted-In: Futures Price Target Technicals Markets Analyst Ratings Trading Ideas

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Related Articles (ES) Technical Update: S&P May Have A Bit More Upside Left Before Healthy Sell-Off Starts Technical Update: S&P Futures Support And Resistance Technical Update: S&P Futures Support And Resistance Around the Web, We're Loving...

No comments:

Post a Comment