Make no mistake about why the U.S. dollar is rising; the long-term health of the world reserve currency is still as precarious as it ever was despite the recent pick-me-ups it's received in foreign exchange markets.

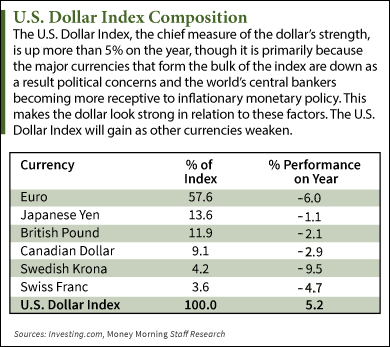

The U.S. Dollar Index, which charts the strength of the U.S. dollar against six world currencies through a weighted geometric mean, is up 5.2% this year, and 1.9% on the month.

But this is more an indication that traders should be bearish on other currencies, as opposed to bullish on the dollar.

The index is comprised of various currencies, each assigned a certain weight that goes into determining the index's final figure. The bulk of the calculation comes from the euro, which makes up 57.6% of the index, followed by the Japanese yen at a 13.6% weight, and the British pound sterling, which comprises 11.9%.

Together, these three currencies represent 83.1% of the index and explain why the main dollar index has been performing as well as it has this year.

The British pound sterling has been making headlines this week because it recently closed at its low on the year of $1.6105. Growing support from the Scottish independence movement has threatened to break up the U.K. and, as a result, stoked investor fears about the nation's currency and prompted some to exit.

No doubt this helped push the U.S. dollar index to a 14-month high, approaching levels it hasn't seen since July 2013. As of market close Tuesday, the dollar index reached $84.42.

But while the stories out of Great Britain may have given the dollar the boost it needed to approach yearly benchmarks, the strength of the dollar has been overstated for more than a year.

"Right now, there's little doubt that the weakening euro and British pound are helping to lift the dollar," said Money Morning Resource Specialist Peter Krauth. "Not that they deserve to be strong, given [quantitative easing]-type policies in both currency zones. I think the dollar's benefitting, as it has so many times in the past, from its safe-haven status, and that's what's pushing it higher temporarily."

Here's what the world's central bankers are doing to devalue their own currency...

The European Push Toward QEEuropean economic policymakers and central bankers are losing their appetite for wide-scale austerity measures first employed as the Eurozone crisis unfolded, and instead are more explicitly advocating inflationary monetary policies to jumpstart the region's stagnating economy.

Plagued by an elevated unemployment of 11.5% and troubling indicators signaling disinflation, the austerity calls are being hushed by much louder cries for stimulus.

With the most recent figures for European growth at 0.3%, its lowest level in five years, the European Central Bank (ECB) can't risk having this bout with disinflation morph into a full-on debt deflation trap.

Deflation would add to the real value of debt, hurting borrowers and raising the possibility of a credit crunch. This is the last thing the region needs when countries with the most troubled banks, such as Portugal, Ireland, Greece, and Spain, are beginning to find buyers of their debt outside of the International Monetary Fund (IMF) and European Union (EU) life-support lending facilities.

Inflation would also help bring current accounts in the Eurozone periphery into balance, a factor that has been acting as a headwind to a substantial recovery in the region.

ECB President Mario Draghi surprised Eurozone observers last week when he announced several rate cuts to the central bank's lending and deposit facilities and a plan to buy non-financial asset-backed securities to the tune of 500 billion euros over three years.

He also suggested that a large-scale sovereign bond-buying program, or European quantitative easing, was not far off when he said "Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate."

This will all contribute to a weakening of the euro, and already has helped to prop the dollar up.

But the euro and the pound aren't the only currencies in a slump...

"Abenomics" Weakens the Japanese YenThe Japanese yen has fallen 1.1% on the year, which comes as no surprise given its strict adherence to the so-called "Abenomic" policies that Japanese Prime Minister Shinzo Abe has pursued since December 2012.

"Abenomics" is made up of three main elements called "arrows" that include monetary easing, flexible fiscal policy, and structural reform. Since its inception in 2012, the yen has fallen more than 20%.

The first two arrows are the main culprits behind the yen's plunge.

The first, which entailed monetary policy changes in the Bank of Japan, was announced in April 2013 and known officially as "quantitative and qualitative monetary easing." It looked to increase the monetary base by 60 to 70 trillion yen a year. The program also included an annual purchase of long-term Japanese government bonds to the tune of 50 trillion yen a year to put downward pressure on interest rates.

This was accompanied by the second arrow, which addressed fiscal policy, and amounted to 10.3 trillion yen, or 1.4% of Japanese GDP, in debt-financed stimulus spending.

The multi-pronged "Abenomics" strategy explains why the yen has accelerated its downward plunge and contributed to the relative strength of the dollar.

But the dollar can only ride foreign central banker's missteps so long before it sees itself losing value...

Trouble Ahead for the U.S. DollarOver the last two months, the dollar has shot up over 5%, which is a huge move for any currency to make in such a short period, Money Morning's Krauth said.

He said he sees this as the peak, if it doesn't soon take out its highs experienced in July 2013.

The dollar is on fragile footing at the moment and likely can't sustain this rise.

The biggest threat to the dollar, at least in the short term, will come from the U.S. Federal Reserve, and any sudden policy measures that could instill a lack of confidence in the dollar moving forward.

"I think that what will eventually cause the dollar to weaken significantly will be something that is more U.S.-specific," Krauth said. "If much higher inflation expectations became entrenched, or if the Fed were to stop the current tapering process or even reverse and ramp it back up, then people could look to exit the dollar."

Even more troubling are the threats to U.S. dollar hegemony from China and Russia. The two countries are settling more international transactions in their own currencies, effectively bypassing the dollar all together.

These cues could signal that two major economic powers are weaning themselves off the dollar, further threatening the U.S. dollar's value in international markets.

All of these factors taken together paint a dismal future for the dollar, and put a damper on its recent gains, which themselves have been entirely sparked by forced currency devaluation measures of central bankers abroad.

"I don't think that we're going to see that stay all that strong for that much longer," Krauth said.

Editor's Note: We just released what may be the most important interview of the year on what's ahead for the U.S. economy and stock market. The Federal Reserve, Congress, and the White House are destroying our currency - and creating a $147.6 trillion problem they don't know how to solve. The biggest victims will be unprepared Americans who could see their entire financial future wiped out. Here's the full interview - plus the four steps to take now.

No comments:

Post a Comment