Introduction

In this article I'll follow up on my earlier article on Telefonica (TEF) 'Why Telefonica might be a good investment right now', and have a look at the company's H1 financial results which were published last week. I'll first discuss the numbers, have a closer look at the debt level (as it's one of Telefonica's priorities to considerably reduce this debt) and give my updated opinion at the end of this article.

I recalculated all numbers from Euro to USD using an EUR/USD exchange rate of 1.33.

The H1 Financial results

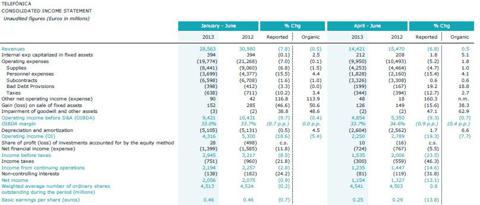

Looking at the consolidated income statement, revenue came in at 28.5B EUR (37.9B USD) which is down 7.8% from 2012's 31B EUR (41.2B USD). The OIBDA margin (Operating Income Before Depreciation and Amortization) remained relatively stable at 33%, down from 33.7%.

The net income came in at 2.06B EUR (2.75B USD), down just 0.9% from 2.08B (2.77B USD) in the same period last year. This stable net income was mainly caused by lower financial expenses (1.4B EUR (1.86B USD) versus 1.59B EUR (2.11B USD) last year) and lower income taxes (751M EUR (999M USD) vs 960M EUR (1.28B USD)). These two accounts had a positive impact of approximately 400M EUR (532M USD) on the net income and that's the main reason why net income was down by less than a percent despite the 7.8% drop in revenue and 9.7% drop in OIBDA.

(click to enlarge)

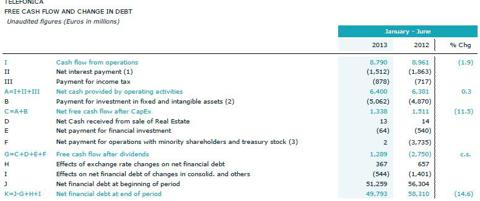

On the positive side, Telefonica generated almost 1.3B EUR (1.73B USD) in free cash flow, even after spending in excess of 5B EUR (6.65B USD) in capex, including 1.1B EUR (1.46B USD) in spectrum payments (of which the UK spectrum auction was the most expensive one, requiring 655M EUR (870M USD).

(click to enlarge)

The debt si! tuation

This free cash flow obviously helped Telefonica to cut its net debt, which stood at 49.8B EUR (66.2B USD) as of at the end of Q2 this year, which is down almost 15% from its level of 58.3B EUR (77.5B USD) at the same time last year. Needless to say Telefonica is progressing well in its efforts to keep the total debt under control and seems to be on the right track to decrease the level of net debt to less than 47B EUR (62.5B USD).

Telefonica says the pro forma net debt as of the publication of the results was lower again, standing at 48.6B EUR (64.6B USD), after selling a 40% stake in certain Central American assets as well as selling T. Ireland).

The net debt/OIBDA ratio as at the end of H1 2013 stood at 2.40, which is acceptable. When recalculating the net debt/OIBDA ratio using the updated debt level of 48.6B EUR (64.6B USD), the ratio drops to 2.34-2.36.

The proposed acquisition of KPN's German assets for a consideration of 5B EUR (6.65B USD) in cash (and 3B EUR (4B USD) in stock) will obviously have an impact on the debt and OIBDA-level, and I'm looking forward to get more information such as pro forma numbers on a potential combined entity. I'm also very curious to see whether or not this deal will be allowed to go through by the German and European Telecom watchdogs.

Conclusion

Telefonica seems to be on the right track to reduce its debt levels as the company generated a substantial amount of free cash flow in the first half of this year, which reduced the debt level to less than 50B EUR (66.5B USD). Subsequent divestment of assets had another positive impact of in excess of 1B EUR (1.33B USD) on this debt level.

I'm curious which impact the proposed acquisition of E-Plus will have on the company's balance sheet, net debt position and Net Debt/OIBDA ratio. As it's almost certain this deal will be subject to an investigation by the telecom watchdogs, I don't think this acquisition will be completed before year's end, so it's very likely Telefonica ! will reac! h its target of 47B EUR (62.5B USD) in net debt.

Telefonica expects to pay a dividend in November of this year, and I'm curious if this dividend will be payable in cash or if shareholders will have a choice to elect a stock dividend (which are tax-free in Spain). If half of the shareholders would elect to receive a dividend in stock, this would save Telefonica a cash outflow of approximately 1.7B EUR (2.25B USD) for 2013 (assuming a 0.75 EUR (1 USD) gross dividend).

Telefonica seems to tick all the boxes it promised to tick, and after reading the H1 results, I'm almost certain the company will meet its projected maximum net debt position. At the current share price and proposed dividend, Telefonica has a dividend yield of in excess of 7%.

Disclosure: I am long TEF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment