Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does United Rentals (NYSE: URI ) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

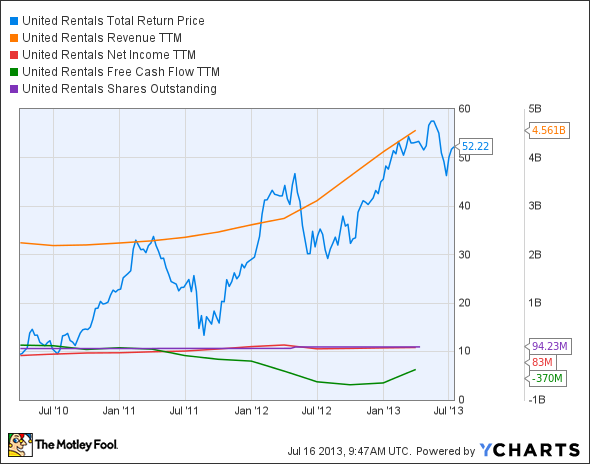

The graphs you're about to see tell United Rentals' story, and we'll be grading the quality of that story in several ways:

What the numbers tell you

Now, let's take a look at United Rentals' key statistics:

URI Total Return Price data by YCharts

| Revenue growth > 30% | 112.9% | Pass |

| Improving profit margin | 223.5% | Pass |

| Free cash flow growth > Net income growth | (313.7%) vs. 362.7% | Fail |

| Improving EPS | 250.4% | Pass |

| Stock growth (+ 15%) < EPS growth | 442.3% vs. 250.4% | Fail |

Source: YCharts. * Period begins at end of Q1 2010.

URI Return on Equity data by YCharts

| Improving return on equity | (94.4%) | Fail |

| Declining debt to equity | 107.6% | Fail |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we're going

United Rentals doesn't look like it's earning its gains today, with only three out of seven possible passing grades. A big source of that weakness is the company's falling free cash flow, which has diverged markedly from its net income over the past two years. In addition to this, return on equity has dipped significantly, thanks to an increase of over 50% in the share count since the start of our tracking period. Will United Rentals be able to turn this weakness around and rebound, or is it going to get returned with a few more dings than it left the lot with? Let's dig a little deeper.

United Rentals has over 830 rental locations in the U.S. and Canada, and controls 13% of the North American market for construction and industrial equipment rentals. The company has found itself entangled in scandals in the past, the most notorious of which involved some shady lobbying practices that occurred around a decade ago. That ought to be water under the bridge by now, but it's still something to keep in the back of your mind. The company also has a working capital deficit, and it seems to solve its debt problems via the issuance of new shares. That's good for avoiding debt overhangs, but it doesn't do long-term shareholders any favors unless United Rentals can keep powering earnings higher.

United Rentals recently acquired RSC Rentals, and is still integrating the acquisition. That expanded the company's footprint across North America, and absorbing a competitor also reduced costs and helped drive revenue growth this year. It has also allowed United Rentals to add higher-margin clients to its base.

United Rentals should also benefit from an uptick in demand from the housing and construction recovery. In addition, United Rentals' sales force is responsible for 38% of its business, which comes from unassigned accounts that are typically local contractors working on a job-to-job basis. The company has approximately 1,200 outside sales representatives in the field, and it has plans to increase that number by 10% in the next year. By working on growing this 38% base, or otherwise converting some of it into long-term relationships, United Rentals can increase its revenue and profit.

Last quarter, United Rentals' revenue spiked by 68%, to $1.1 billion, but EPS only moved higher by 12%. This growth is expected to continue as the firm targets recovering heavy-equipment using customers, namely the industrial, construction, manufacturing, and utility homeowner segments, as well as government entities. Customers increasingly prefer to rent equipment rather than buying it, a result of the caution created by this recession-scarred economy. According to the American Rental Association, the forecasted growth rate for the equipment rental industry is more than four times expected 2013 GDP growth in the United States. Even though United Rentals isn't perfect now, it has plenty of evident opportunities to improve.

Putting the pieces together

Today, United Rentals has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

No comments:

Post a Comment