Cumberland Pharmaceuticals (CPIX) is a small cap pharmaceutical company that already has three drugs on the market. One thing that makes it stand out from many other companies with its market cap is the fact that Cumberland is already profitable. Cumberland's extension of the distribution agreement with Cardinal Health is important to helping to continue to drive revenue growth out of Cumberland's current pipeline. Cumberland's three drugs have the potential to grow even more over the long term, and Cumberland is attempting to build a pipeline that will allow for even more long term oriented growth. Cumberland appears to be a solid value for long term oriented shareholders.

Acetadote

Cumberland's biggest drug by far is its drug Acetadote. In recent years, however, it has had some trouble making sure that it is patented. The original patents were set to expire, so Cumberland even reformulated Acetadote, which allowed for more patent protection, and subsequently to protect its key product. A key event happened recently when CPIX announced a settlement with generic drug makers Paddock and Perrigo, that they will not attempt to challenge CPIX's patents on Acetadote again until 2026. This is important, as Acetadote is responsible for a large amount of CPIX's revenue.

Also, the fact that Cumberland has signed an agreement with Perrigo that if someone obtains ANDA approval before Perrigo, that Cumberland will supply them with an authorized generic helps to put Cumberland in a position to help offset part of its revenue loss. Sure the loss of Acetadote would be huge, but Cumberland would make at least some money off of providing Perrigo with the authorized generic.

The authorized generic came into play after the FDA approved a ANDA for the old version of Acetadote towards the end of last year. Cumberland subsequently shipped its authorized generic to Perrigo and filed a lawsuit against the FDA in the hopes that it will stop the FDA from approving any more ANDA applications. C! umberland saw $3 million in revenue as a result of the authorized generic shipments to Perrigo for the most recent quarter. Cumberland should, however, be able to distinguish itself from the generics due to the reformulation, being EDTA free. Cumberland should also be able to distinguish itself through the recently announced updated labeling for its product.

Generic competition would normally be a negative indicator for long term shareholders. Although Cumberland may be the exception, with its ability to distinguish its reformulated product from the generics this should help to minimize any revenue loss, as well as with the recent issuance of another patent to Cumberland, Cumberland is increasing its intellectual property position surrounding Acetadote. Cumberland has shown its ability to generate revenue through the authorized generic. If the lawsuit against the FDA is successful, Cumberland should still be able to help stave off the revenue loss typically associated with generic products. Cumberland has to tread rather carefully in order to try to keep Acetadote sales intact, and the recent quarter suggests that Cumberland is able to keep its sales intact.

Caldolor

Cumberland has spent a great deal of time and money trying to promote its drug Caldolor. Caldolor has had a string of quarters where it produced record revenues, and this is a positive sign for shareholders (however the amounts of revenue were still relatively small). The drug represents a very important catalyst for long term investors to see whether or not Caldolor can live up to its potential. Caldolor is an ibuprofen injection, primarily used in hospital based settings. This drug will likely drive Cumberland's long term growth. Cumberland is very focused on getting the drug widely used in hospital settings and is slowly ramping up sales of the drug. Cumberland has a goal of by year end having Caldolor stocked at 1,000 facilities across the nation.

For long term oriented shareholders only time will tell if this dr! ug can tr! uly meet the potential that Cumberland once thought that the drug had. Significantly, Cumberland has plans to submit a request to the FDA to update the labeling for Caldolor based on the results of recent clinical trials. Should the label be updated, it could help to generate stronger revenue growth from Caldolor if the label is broadened in any way. Another positive sign for long term oriented shareholders with respect to Caldolor is the fact that in the most recent conference call, there was mention of 'accelerated reorders over the past year.' This is a positive sign for shareholders that doctors are trying the drug and are satisfied with the efficacy, and coming back to use the drug more in their patients. Caldolor is already approved for marketing in the United States, and Cumberland has also been focused on rolling the product out internationally.

This initiative is evident through the recent licensing agreement with a pharmaceutical partner in India. These international opportunities are significant for Cumberland, as they represent opportunities to substantially increase revenues, with little to no cost to the company. Almost all, if not all, of the royalty revenue earned from such licensing agreements would be able to go to Cumberland's bottom line, which is very good for shareholders. Caldolor has over the past few years been sneaking its way into hospitals, and Cumberland is looking to continue to expand their growing customer base for Caldolor.

Kristalose

Cumberland also has another drug on the market named Kristalose, which is a prescription laxative. Kristalose accounts for a rather small amount of Cumberland's overall revenues per quarter. Cumberland has recently taken initiatives to try to increase Kristalose sales through a coupon and adding an eprescription enhancement. Should these efforts be successful in driving more interest to Kristalose, it could be a piece of unexpected upside for short to mid term investors.

However, Cumberland is taking a similar strate! gy with K! ristalose in terms of licensing. Cumberland will continue to be selling the product in the United States, while it will attempt to have people license the rights to Kristalose in other parts of the world. This would also provide royalty revenue, at very little if any cost. This royalty revenue would essentially all go to the bottom line and help increase Cumberland's net income for shareholders. With Cumberland announcing new initiatives to try to grow sales domestically, as well as attempting to generate revenue outside of the United States through licensing agreements, Kristalose has the potential to still contribute to Cumberland's long term growth prospects.

Hepatoren

Cumberland is not, however, simply out of ideas for new drugs. In 2011 Cumberland acquired the rights to a drug called Hepatoren. This drug is currently in phase II testing for the treatment of hepatorenal syndrome (HRS). Hepatorenal syndrome is a sometimes fatal, and can cause damage to the liver. Significantly, Cumberland will attempt to develop Hepatoren as an orphan drug, through which it can gain market exclusivity as well as increased protection.

This drug would have huge potential if successful in clinical trials. An important concept as to why this drug fits so well into Cumberland's pipeline is the fact that many of the doctors who would prescribe Hepatoren are the same doctors that are being targeted by the Acetadote sales force. With this in mind, Cumberland would be able to leverage its existing sales force and generate sales for the drug without substantially increasing its general and administrative costs. Hepatoren would also likely be able to command a rather high price, given the fact that it will be developed as an orphan drug. Many times orphan drugs are able to command high prices due to a limited pool of patients who are able to be treated by the drug.

With the study not yet completed, it is not clear how effective the drug would be in treating HRS. The estimated completion date for ! the Phase! II study is December 2014, so investors should have a much better idea then about the potential development avenues for Hepatoren. If the drug is successful in phase II testing and reaches phase III testing, it should represent a very important set of catalysts for shareholders. The market would likely become much more interested in Cumberland, as the product gets closer and closer to giving phase III data results. Other catalysts would include the filing of a NDA and the eventual FDA acceptance of the drug. Hepatoren has the potential to help contribute to the share price of Cumberland as Hepatoren progresses through the various phases of clinical testing. Long term oriented shareholders will likely be keeping an eye on Hepatoren and hope that the company will be able to have Hepatoren advance through the pipeline relatively quickly in order to combat the potential loss of revenue from Acetadote competition.

Cumberland Emerging Technologies

Cumberland Emerging Technologies (CET) is likely one of the most important areas of the company for any investor interested in long term growth. CET attempts to in-license therapeutic candidates that Cumberland believes have the potential to be successful in clinical testing. CET identified the opportunity for the Hepatoren candidate, and will be instrumental in growing Cumberland's pipeline. In the most recent conference call, the questions and answers session gave a very interesting insight as to the potential for Cumberland's pipeline growth, with Cumberland's CEO saying that:

Yes, we have an experienced team here that has taken those Acetadote and Caldolor through the development activities needed to achieve FDA approval and registration. And we felt that now that they are finished with the majority of these Phase IV type Caldolor studies, that we can turn their attention to developing a series of attractive new product candidates. So they are busy with those plans and designing of those programs. We haven't announced the nature of the! m yet, bu! t we will be evaluating one at a time, over time

The mention of a series of attractive new product candidates highlights the fact that Cumberland is focused on acquiring new products in order to create additional sources of revenue. It is likely that any new product acquisitions will take place through the help of CET, and that CET will be instrumental in identifying products for potential acquisition. As Cumberland continues to grow its pipeline it will create more catalysts for long term shareholders, as well as helping to drive attention and growth to the stock price as the products advance through clinical testing.

Financial Position

The financial position of the company is very important for any shareholder looking to take a long term position in a stock. A long term oriented shareholder wants to see solid revenue growth, as well as a nice cash cushion for the company, as well as an increasing net income. These ideas will make it much less likely for shareholders to be diluted, and should help to cushion the impact of any negative news regarding Hepatoren.

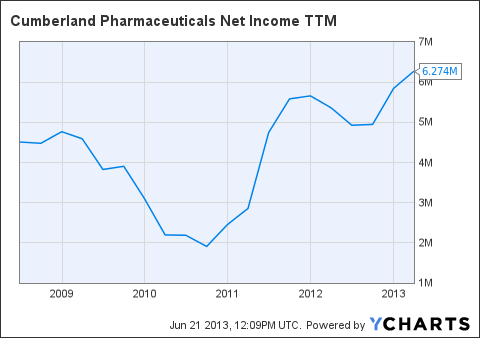

Cumberland is rare amongst small cap stocks with its market cap in the fact that Cumberland is already profitable. Many times, pharmaceutical companies with Cumberland's market cap are going to be deeply in the red with the hope that eventually they will turn a profit through the licensing or commercialization of their drugs. For the most recent quarter, Cumberland reported net income of $0.9 million, or $.05 per share. This is a 150% increase in EPS when compared to the first quarter of 2012, when Cumberland reported $0.02 EPS. Cumberland is also sitting on a rather large pile of cash and marketable securities, $70.2 million to be exact. Cumberland also reported a positive operating cash flow for the quarter. With a relatively little amount of debt, Cumberland does not seem to be under any financial pressure. Revenue is of course expected to grow a little bit this year. Cumberland has been reporting increases in net incom! e over th! e past few years, and it appears as though this trend is set to continue.

CPIX Net Income TTM data by YCharts

With an increasing net income and a rather large pile of cash to drive future acquisitions, it appears as though Cumberland is in a very solid financial position. Investors should not be concerned any time soon about dilution unless Cumberland finds a very attractive product candidate that it would have to pay a large amount of upfront money in order to license.

Conclusion

Cumberland is currently undervalued by the market. As long as revenue growth continues, and as long as investors see interest in licensing Cumberland's products, Cumberland will have the potential to increase its Price per share. Cumberland is focused on generating long term value for shareholders and has the potential to drive that value based on the in-licensing of product candidates, as well as continued sales growth of its already approved products. For Cumberland the last few years, they have not seen huge amounts of growth. However, with a targeted sales force now in place, as well as with the increasing amounts of international partnerships it appears as though Cumberland is finally set up to be able to provide substantial upside over the long term. Cumberland appears to be a very rare small cap stock in the fact that it is already profitable, and in the fact that it has asymmetric upside potential over the long term.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment