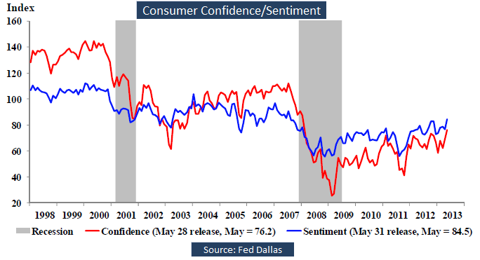

Amidst an economic slump in the eurozone and weak economic growth in China and India, the US economy has shown strong resilience. My point is underscored by the fact that the consumer confidence in the US is at its highest since the recession of 2008-09.

click to enlarge images

Given the current economic scenario in the US, I am of the opinion that the Fed can pause on its asset purchase program. Discussed below are the reasons for believing that it might be a good step at this point of time.

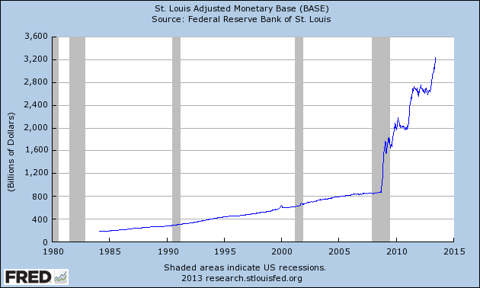

The Fed has been aggressively expanding on its balance sheet ever since the crisis began. This is reflected in the increase in the adjusted monetary base from $800 billion at the beginning of 2008 to $3.2 trillion as of June 2013.

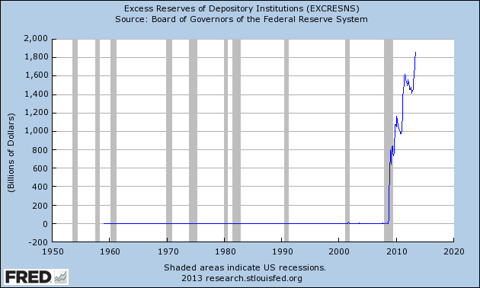

Considering the liquidity freeze post the Lehmann collapse and the banking crisis subsequently, the asset purchase program helped in stabilizing the banks and financial institutions. However, in the years after the crisis, the scenario has changed significantly in the US banking system. The US banks currently have $1.8 trillion in excess reserves deposited at the Fed. This is indicative of the comfortable liquidity scenario in the banking system currently. Further, the banks are also earning an interest of 25 basis points on the excess reserves at the Fed.

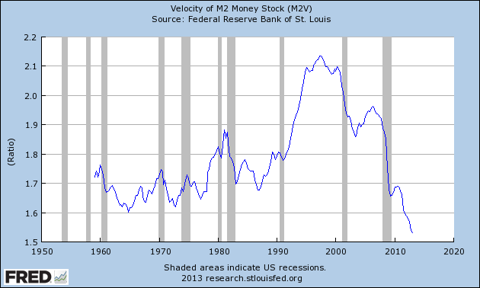

The point that I am trying to make here is that the expansionary monetary policy of the Fed has only resulted in excess reserves for banks as the banks tighten lending standards. In other words, the money is not flowing into the real economy through credit growth. One can concl! ude that the current QE program is helping banks and financial institutions more than the real economy. Therefore, the Fed needs to pause on its balance sheet expansion and figure out the implications of the same on the real economy.

I am of the opinion that if the Fed decides to pause on the asset purchase program, the impact on the real economy will be minimal. Even with the QE in progress, the money velocity in the United States is at its lowest in decades.

Another important reason for believing that it might be the right time for the Fed to pause on its asset purchase program is the direction of long-term government bond yields. The yield on the 10-year bond has increased from 1.63% in the beginning of May to 2.13% currently. A 50 basis point increase in yield in a one month time frame is significant. There are two probable reasons for an increase in yield and both reasons boil down to one conclusion - Pausing of the asset purchase program.

The first reason is the obvious reason of fear related to inflation as excess money floods the banking system and manifests itself in the form of asset inflation. The second reason relates to a gradually declining impact of bond purchases on the yields.

Instead of expecting to lower yields through bond purchase, the Fed can try lowering the yields by ending the asset purchase program. As asset markets are addicted to easy money, a pause in the asset purchase program can result in some correction in risky asset classes and lowering of government bond yields as investors park their money in relatively safer assets.

Investors and readers might point out that it might not be the right time to scale down the asset purchase program as the Fed has still not met its unemployment target of 6.5%. I am of the opinion that the current expansionary monetary policies are hardly helping in creating employment! . As show! n in the charts above, the banks have tightened lending standards and the expansionary monetary policy does not translate into credit for small businesses, which can spur growth.

At the same time, the headline unemployment numbers hardly reveal the real unemployment scenario. The U6 rate is the United States is currently at 13.8% indicating that significant employment is part-time due to economic reasons. Also, the number of people not in the labor force has surged to 89.7 million, which is a record high. A greater number of people opting out of the labour force have resulted in the employment-population ratio languishing at 58.6%, which is the lowest in three decades. Therefore, the impact of the QE on unemployment is debatable.

Having given these arguments, I would still suggest that the Fed stops its bond purchase program and tapers down on its mortgage purchase program. The delinquency rates still remain relatively high for the mortgage debt and a gradual tapering down would be better than a complete pause.

As mentioned earlier, the tapering down of the asset purchase program might have a negative impact on the asset markets addicted to easy money. However, this is necessary at this point of time when speculative activity in the equity markets is high as indicated by the margin debt data. I would therefore remain cautious on fresh exposure to equity markets. I am certainly not suggesting that markets are undesirable for the long-term. Any correction in equities can be considered for exposure to quality stocks and the S&P 500 index (SPY).

In conclusion, the Fed needs to rethink its strategy than just flooding the financial system with liquidity. Excess liquidity and highly expansionary monetary policies have unintended consequences, which might not be desirable for the investment community and for the economy. The high volatility in Japanese equities is just an example of the unintended consequences of ultra expansionary monetary policies. In trying to avoid a Japanese sty! le deflat! ion, the US should not get into the trap of Abenomics.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment